Imagine being able to choose how you earn money – whether by working for someone, working for yourself, owning a business, or letting your money work for you. Each of these paths represents a different Cashflow Quadrant, a concept that categorizes the sources of income into four distinct types. Mastering these quadrants is key to achieving income freedom, where your livelihood no longer depends solely on trading time for money. This guide will walk you through each quadrant – Employee, Self-Employed, Business Owner, Investor – explaining their mindsets, financial implications, pros and cons, and how you can transition from one quadrant to another on your journey to financial independence. The tone here is both motivational and informative: by the end, you’ll see that no matter where you start, you can move towards greater financial freedom with the right mindset and strategies.

What is the Cashflow Quadrant?

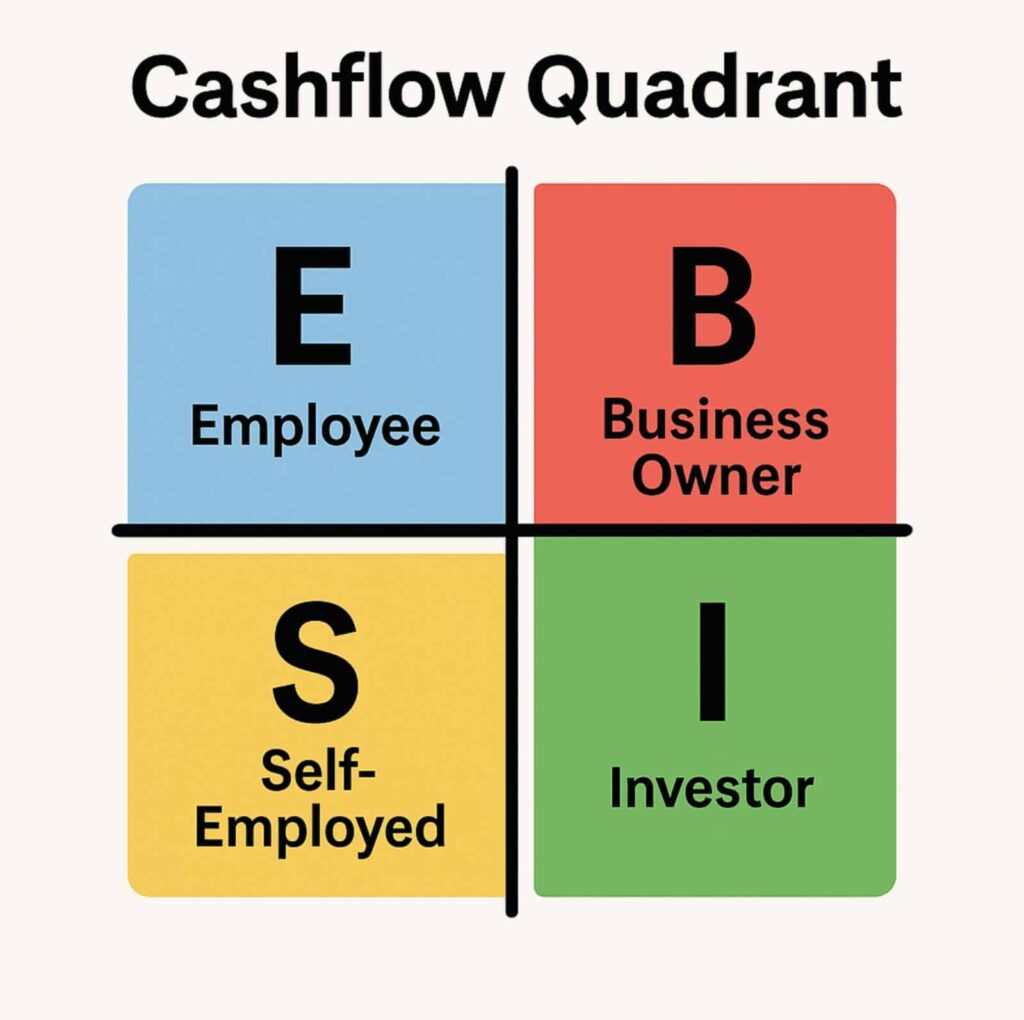

The Cashflow Quadrant model divides the ways people earn income into four categories (Employee, Self-Employed, Business Owner, Investor), as illustrated above. The left side (E and S) represents active income (trading time for money), while the right side (B and I) represents forms of passive income where systems or investments generate money.

At its core, the Cashflow Quadrant is a framework to understand how you earn your income. It was popularized in the 1990s by a financial educator and has since become a foundational concept in personal finance. The quadrant is typically drawn as a cross with four sections labeled E, S, B, I for the four income types:

- E – Employee: You work for someone else and receive a paycheck.

- S – Self-Employed: You work for yourself (or own a small business) and your income depends directly on your efforts.

- B – Business Owner: You own a business system and have people (or processes) working for you.

- I – Investor: You put money into investments and your money works for you to generate returns.

Each quadrant not only describes what you do for income, but also reflects a distinct mindset and lifestyle. For example, the left side (Employees and Self-Employed) is associated with seeking security and exchanging time for money, whereas the right side (Business Owners and Investors) is focused on leverage, passive income, and long-term wealth creation. The ultimate goal of “income freedom” is typically achieved on the right side of the quadrant, where you are no longer limited by the hours you personally work. However, as we’ll explore, each quadrant has its own advantages, challenges, and psychology.

In the following sections, we dive deep into each quadrant – what it means, the pros and cons, and the mindset required – and then discuss how to progress from one quadrant to another in today’s digital and global economy.

Quadrant 1: Employee (E) – Trading Time for Security

Definition: An Employee earns income by working for someone else’s company or organization, trading time and skills for a steady paycheck. Employees typically enjoy benefits like job security, fixed working hours, health insurance, and possibly retirement plans. In essence, they “have a job” and rely on an employer for their income and direction.

Mindset and Lifestyle: Employees often value security and stability. The employee mindset is one that prioritizes a reliable paycheck and clear expectations – many are comfortable knowing exactly what their role is and that if they put in the hours, they will get paid. The trade-off for this security is limited control over one’s time and financial upside. As an employee, your schedule, tasks, and income are largely dictated by your employer’s decisions and the company’s salary structure. Psychologically, employees may have a risk-averse outlook, preferring the stability of a job to the uncertainty of venturing out alone. They might focus on earning and saving from their wages (often a scarcity mindset centered on budgeting), rather than aggressively seeking wealth-building opportunities.

Financial Implications: Employees earn active income – meaning you must continuously work to get paid. If you stop working (quit or lose your job), the income stops. There is usually little passive income in this quadrant (income that flows without your constant effort). Employees also tend to have the highest tax burden; in many tax systems, salaried wages are taxed at a higher rate or with fewer deductions compared to business or investment income. In fact, employees (and the self-employed) “pay the most in taxes” in relative terms. This can slow down wealth accumulation, as more of your earnings go to taxes and expenses before you can invest or save.

Pros of Being an Employee:

- Job Security & Predictability: Steady paycheck and benefits provide financial stability. You know exactly what to expect each month in income.

- Simplified Responsibility: You typically have a defined role; you can focus on your specialty while the employer handles the business operations, overhead, and big decisions.

- Benefits & Perks: Many traditional jobs offer health insurance, retirement contributions, paid leave, and other benefits that can add significant value to the compensation package.

Cons of Being an Employee:

- Limited Income Growth: Salaries are often capped by role or industry standards. Raises and promotions happen occasionally, but your earning potential is ultimately controlled by someone else. It’s hard to get exponentially richer purely through salary.

- Time for Money Trade: You have to keep working to keep earning. If you take a long break or cannot work, your income ceases. There is no passive income – your time is your money. This creates a dependency on the job.

- Lack of Autonomy: You have limited control over decisions and schedule. Your employer can change your duties or fire you, which means your financial well-being isn’t fully in your own hands. Many creative or entrepreneurial ideas you might have must be approved by others.

In summary, the Employee quadrant offers comfort and stability – it’s a common starting point for most people’s working life. It can be a fulfilling choice if you value security or if you love your profession and don’t mind the structure. However, it’s often the hardest quadrant in which to achieve financial freedom, because your income is tied to your continued labor and someone else’s system. If your goal is greater wealth or independence, you may eventually look to transition out of the E quadrant or supplement it with other income streams (for example, investing on the side). Next, we’ll look at what happens when you step out on your own in the S quadrant.

Quadrant 2: Self-Employed (S) – Owning Your Job

Definition: A Self-Employed person works for themselves and is their own boss. This quadrant includes solo business owners, freelancers, independent professionals (doctors, lawyers in private practice, consultants), gig workers, and anyone who essentially *“owns a job”*. Instead of drawing a salary from an employer, they earn income directly from their own business or labor – through fees, commissions, or small business profits. They might operate as a one-person company or have a few employees, but the key is that the business’s success relies heavily on their own effort.

Mindset and Lifestyle: The self-employed embrace independence and control. They often have an entrepreneurial spirit in the sense of wanting to do things their own way. The S quadrant mindset says, “I trust my own skills more than someone else’s system.” Self-employed individuals take pride in being their own boss and usually feel a strong sense of responsibility for all aspects of their work. They enjoy the autonomy – decisions don’t require corporate approval – and often find fulfillment in building something personal. However, this autonomy comes with added responsibility and pressure. In many cases, people in S quadrant have a perfectionist or “do-it-yourself” mentality. A common trait is believing “no one can do it better than me,” which, while driving high standards, can also become a bottleneck if they struggle to delegate tasks. From a psychological perspective, self-employed people still often carry some scarcity or security mindset, in that they feel they must personally work hard for every dollar – they’ve just chosen to work hard for themselves rather than for an employer.

Financial Implications: Like employees, the self-employed earn primarily active income – if they don’t work, the money likely stops. In fact, many self-employed individuals find they work longer hours than they did as employees. A freelancer or small business owner often has to wear multiple hats (marketing, sales, service delivery, admin), which can mean 60- to 80-hour workweeks, especially in startup phases. Income can be highly variable – one month might be great, the next slow, adding financial uncertainty. Also, taxes can be high; self-employed people typically pay both income tax and self-employment taxes (covering what would be an employer’s contribution to Social Security/Medicare in the U.S., for example). This again mirrors the notion that on the left side (E and S), you often **“pay high taxes and trade time for money”**. One financial benefit in this quadrant is potentially higher income ceiling than a fixed salary – a successful consultant or small business owner can, in theory, earn more than an employee if they find enough clients or customers. However, scalability is limited because one person only has so many hours and energy. It’s often challenging for S-quadrant people to scale income beyond what they personally can do, leading to the classic problem of being “owned by the job.”

Pros of Being Self-Employed:

- Autonomy and Freedom: You call the shots. Self-employed individuals have the freedom to choose their projects, set their hours, and shape their business to their liking. This can be deeply empowering – success and failure are in your hands, not a boss’s.

- Potential for Higher Income (Unlimited Earnings): Unlike a salaried job, there’s theoretically no cap on what you can earn – it depends on the effort and success of your venture. If business is good or you set high fees, your income can surpass what you might earn as an employee in the same field.

- Personal Satisfaction and Passion: Many people go into self-employment to follow a passion or talent. There’s pride in creating something of your own and directly seeing the results of your hard work. You build your brand or asset, not someone else’s.

Cons of Being Self-Employed:

- Long Hours & Burnout Risk: Being your own boss can quickly turn into working harder and longer than any 9-to-5 job. Self-employed individuals often find it hard to “switch off” because there’s always more to do when you are responsible for everything. This can lead to burnout since scaling is hard and *“if you don’t show up, you don’t get paid.”*

- Income Instability: Without a steady salary, income can fluctuate significantly. One slow month can hurt, and there’s usually no sick leave or paid vacation. You carry the financial risk of the business directly – a lost client or a failed project hits your wallet immediately.

- Difficulty Scaling & Delegating: Many self-employed people hit a growth ceiling. It’s challenging to expand because maintaining quality and consistency often means they are reluctant to delegate. Trying to do everything yourself can limit how big your business can get and can be overwhelming. Additionally, every task (even those outside your expertise like accounting or marketing) becomes your responsibility, which can be stressful.

In summary, the Self-Employed quadrant offers freedom at the cost of security. It’s a path for those who crave independence and are willing to work hard for it. Many find it a necessary stepping stone to greater wealth – you learn crucial business skills and have a taste of freedom. However, staying in S long-term can become a trap: you might just create a demanding job for yourself rather than true business ownership. The key to moving beyond S is to learn to leverage others or systems. That’s where the next quadrant, Business Owner, comes in – turning a personally-driven business into a system-driven business.

Quadrant 3: Business Owner (B) – Building Systems and Scaling Up

Definition: A Business Owner owns a system or enterprise that generates income, often without the owner’s direct daily involvement. This quadrant is characterized by building a business that can work for you, instead of you working for it. In practical terms, it means you have employees, managers, or automated processes that keep the business running and profit coming in, even if you step away for a while. The classic description here is that you “own a system and people work for you” instead of you working for someone else or just for yourself. Business Owners leverage other people’s time, skills, and capital to expand their income far beyond what one person could do alone.

Mindset and Lifestyle: The mindset of a successful business owner is strategic and leadership-oriented. Unlike the self-employed who often think “I can do this best myself,” a business owner thinks in terms of systems and teams. They focus on building repeatable processes, finding the right people, and creating value at scale. A key psychological shift here is trust and delegation: realizing that to grow, you must hire others and trust them to do the work, perhaps even better than you could alone. Business owners often have an abundance mindset – they seek opportunities to multiply efforts (through hiring, partnerships, franchising, etc.) and are comfortable investing time and money now for larger payoffs later. They also accept risks as part of growth; however, they mitigate risk by not relying on any single individual (including themselves) for success. Lifestyle-wise, a business owner initially might work extremely hard (when starting the enterprise), but as the business systems and team take shape, they can step back and enjoy more free time because the business can run without them for periods of time. This quadrant offers potentially more freedom than any on the left side – many business owners could take a vacation for a month and find their company not only survives but maybe even thrives in their absence.

Financial Implications: Income in the B quadrant is often a mix of active and passive, skewing increasingly passive as the business matures. Business owners draw profits, dividends, or owner’s salary from their companies. If well-structured, a business can generate passive income for the owner – for example, you set up a shop that your employees run day-to-day, or an online business that sells products while you sleep. Scalability is the huge financial advantage: by leveraging others, a business can grow exponentially. There’s essentially no direct link between your personal hours and the company’s earnings – you could double your customers or production without doubling your hours (you might hire more staff, for instance). This is how large wealth is often built. Additionally, tax advantages often favor business owners. Companies can deduct many expenses, and owners often pay themselves in tax-efficient ways (through dividends or reinvesting profits). It’s noted that business owners and investors generally “pay much less in taxes” compared to employees or solo workers. Governments incentivize business owners because they create jobs and economic growth. Of course, starting a business comes with financial risk – you might invest capital upfront, possibly incur debt, and there’s a chance of failure or irregular income. But the upside potential is significant: equity in a successful business can be worth millions, and the business can often be sold as an asset (something not possible when you are the business in S quadrant).

Pros of Being a Business Owner:

- Leverage and Passive Income: You are no longer limited to your own 24 hours a day. By leveraging employees, technology, and systems, your business can make money around the clock and grow beyond what one person could do. This means you can earn income even when you’re not actively working – the essence of passive income and true scale.

- Greater Freedom of Time: With a well-run business, you can step away without income stopping. You can take vacations, focus on big-picture ideas, or even run multiple businesses. The business owner has far more control over their time than E or S quadrants once the business is stable. In other words, you own systems that earn for you, giving you flexibility.

- Wealth Creation and Equity: A successful business increases in value over time. Not only do you get ongoing profits, but you’re also building an asset (the company itself) that can be sold or passed on. This is a common path to significant wealth – many of the world’s richest people are business owners. It’s often said that the right side (B and I) is where true wealth and financial freedom are achievable.

Cons of Being a Business Owner:

- Initial Risk and Effort: Starting or buying a business can require a lot of capital, time, and risk. There’s no guarantee of success; many businesses take years to turn a profit. In the beginning, business owners often work extremely hard (wearing many hats like an S) until they can build a reliable team. The stress of responsibility – for overhead, for employees’ livelihoods, for loans or investors – can be significant.

- Leadership and Management Challenges: Not everyone naturally has the skills to manage people and systems. Being a B means you have to trust others and build a good team. Hiring, training, and leading people can be challenging. Mistakes in leadership can cause business failure. Essentially, you must transition from a specialist (in S) to a generalist leader who guides others. This mindset shift to leadership is crucial and not easy for everyone.

- Complexity and Liability: Running a company involves dealing with complex issues – legal compliance, market competition, economic changes, employee issues, etc. You often have to navigate uncertainty and adapt to change (think of a business owner during a recession or a sudden supply chain issue). There’s also liability: if the business fails, you could face financial losses. The responsibility is much heavier than that of an employee; some find this pressure difficult to handle.

In summary, the Business Owner quadrant is where you shift from working in your business to working on your business (or not working at all in it). It represents a major mindset evolution: from self-centric productivity to organizational productivity. The rewards can be immense in terms of both wealth and freedom. Many who seek financial independence aim to reach this quadrant, as it opens the door to eventually moving into the Investor quadrant with substantial resources. The next and final quadrant, Investor, is all about making your money generate more money – the epitome of “passive income.”

Quadrant 4: Investor (I) – Money Working for You

Definition: An Investor earns money purely through investments – by deploying capital into assets that yield a return. In this quadrant, you “have money working for you”, meaning you might spend your time researching and managing investments, but you’re not exchanging time for money as directly as in other quadrants. Common examples include investing in stocks, bonds, real estate, private businesses, or any asset that can appreciate or produce income (like dividends, interest, or rental income). Investors own assets – such as shares of companies, properties, or intellectual property – and those assets produce income. This is the most passive form of income generation among the four quadrants.

Mindset and Lifestyle: The investor mindset is all about wealth building, patience, and calculated risk-taking. Successful investors think in terms of long-term gains, compounding, and portfolio strategy. They often have an abundance mindset, looking for opportunities where their money can multiply itself. Importantly, investors learn to separate their time from their income – money doesn’t have the same emotional attachment of “must work to earn” as it might for someone on the left side. Instead, they see money as a tool. Psychologically, investors need discipline to avoid impulsive decisions; they rely on knowledge, research, and sometimes expert advice to make sound investments. They are comfortable with delayed gratification – for instance, investing in an asset and waiting years for it to pay off. The lifestyle of an investor can be very free: if one’s investments are large and well-structured, you might live off interest, dividends, or growth without needing a traditional job at all. However, reaching that point usually comes after years of earning or building capital (often via the other quadrants). Many investors remain actively engaged in managing their portfolios – but it’s by choice and intellectual interest, not because they have to work daily.

Financial Implications: Income from investments is typically passive or residual. For instance, as an investor you might receive: dividends from stocks, rental income from properties, interest from lending money, or profits from businesses you’ve invested in (without working there). The beauty is that this income can continue 24/7 and even grow over time with little direct effort from you once the investment is made. Investors often benefit from the strongest tax advantages as well – many countries tax capital gains and dividends at lower rates than wage income. This means investors can keep more of their returns, fueling faster wealth accumulation. Diversification is an important concept here: to reduce risk, investors spread their money across various assets or markets. Unlike a business owner whose wealth might be largely tied to one company, a pure investor might have dozens of different investments. Risks in the I quadrant include market fluctuations, the possibility of losing capital, and the need for knowledge – uninformed investing can lead to losses. Also, this quadrant often requires an initial lump of capital to generate meaningful income (though one can start small, significant passive income usually comes from substantial investments). A noteworthy point: by the time someone is primarily an investor, they have often accumulated capital from B quadrant activities or high-income jobs. However, everyday individuals can and do start investing early with small amounts, growing their investor quadrant steadily on the side.

Pros of Being an Investor:

- True Passive Income: This quadrant can potentially provide income completely detached from your daily work. Your money earns money, sometimes even while you sleep. With a well-diversified portfolio, you might cover your living expenses through returns and essentially be financially free.

- High Wealth Potential: Smart investments can grow exponentially through compound interest and asset appreciation. Over years or decades, investments can multiply far beyond what you could save from a paycheck. This is how many individuals become very wealthy – through owning stocks, real estate, or stakes in businesses that balloon in value.

- Flexibility and Freedom: As an investor, you have immense control over your time and can live off portfolio income if it’s sufficient. You can often work from anywhere (managing investments via phone or laptop). It’s a quadrant where retirement or early retirement becomes possible – if your investments generate enough, you no longer need to work actively at all.

Cons of Being an Investor:

- Requires Capital (and Knowledge): To earn a sizable income from investments, you generally need substantial capital or assets invested. This often is accumulated from time spent in other quadrants or by diligently saving. Also, if you lack financial knowledge, investing can be daunting. There is a learning curve to understand markets, evaluate opportunities, and avoid scams or bad investments. Without know-how, you could lose money.

- Market Risk and Uncertainty: Investments are subject to market forces beyond your control. Stock markets can crash, real estate values can drop, businesses can fail. There’s inherent risk, and returns are not guaranteed. Emotional discipline is needed to weather downturns without panic-selling. Some find the uncertainty stressful compared to a steady paycheck.

- Patience and Delayed Gratification: Building up the investor quadrant often takes time. Unlike a salary that pays now, investments might take years to yield big results. It requires patience to let money compound and a long-term perspective. Some people struggle with this and may dip into investments prematurely or get discouraged by early losses.

In summary, the Investor quadrant is the pinnacle of passive income – it’s where you truly make money work for you. It often represents the endgame of the journey to financial freedom. Many people start in E, move to S or B to earn more, then channel those earnings into I to secure their financial future. However, even if you never own a big business, you can participate in the I quadrant (e.g., by investing part of your salary or running a small investment portfolio). Today’s world has made investing more accessible than ever – even “micro-investing” apps let beginners start with just a few dollars. Mastering this quadrant means understanding risk, educating yourself financially, and being willing to take calculated leaps of faith with your money. Next, we’ll discuss how you can move between these quadrants, because your current quadrant need not be your final one.

Active vs. Passive: Mindset Shifts from Left to Right

One of the most important lessons of the Cashflow Quadrant is the contrast between the left side (Employee/Self-Employed) and the right side (Business Owner/Investor) – not just in how income is earned, but in how people think and approach life. On the left, income is active: you work to earn every dollar, and if you stop, the income stops. On the right, income becomes more passive: your assets and systems generate income, even when you’re not actively working.

This requires a significant mindset shift. People on the left side often have what’s called a scarcity mindset, focusing on job security, saving money, and avoiding risks – essentially making sure they have “enough” to get by. In contrast, those on the right side embrace an abundance mindset, looking to create wealth, seize opportunities, and multiply their resources through smart risks. For example, an employee might think in terms of cutting expenses and getting a higher salary, whereas a business owner thinks about expanding revenue streams and making investments pay off. Neither mindset is “wrong” – but to move to the right side, one must gradually adopt the mindset of growth, investment, and comfort with uncertainty.

Another key difference is control and risk. On the left, individuals often feel more secure because they rely on established structures (an employer or their own steady workload). On the right, one takes on more entrepreneurial risk, but also gains more control over one’s destiny. A business owner accepts the possibility of failure in exchange for the chance to build something bigger than themselves. An investor accepts market ups and downs in exchange for the potential of greater long-term returns than a salary could provide.

Taxation and legal structures also differ. Employees and self-employed pay taxes on earned income, often at higher rates, and usually after-tax money is what they invest or save. Business owners and investors often can use pre-tax money for investments or pay taxes on capital gains which tend to be lower. This means the system itself rewards those who can move to the right side, which is why many financial educators stress moving from earned income to passive income as you progress.

The psychological shift can’t be overstated. It involves moving from “I need a paycheck to be secure” to “I create value, assets, and systems that produce income”. It’s about learning to trust in assets and businesses to sustain you, rather than your own direct labor. This shift requires financial education, self-confidence, and often mentorship or role models. It also requires overcoming fear – fear of losing a steady job, fear of business failure, fear of investment loss. Those on the right side are not free of fear; they have learned to manage it and take calculated risks, viewing failures as lessons on the road to success.

In today’s digital economy, making this shift has become more achievable for the average person (as we’ll explore soon). But it starts with mindset: adopting a learner’s attitude, being willing to try new income methods, and thinking like an investor or entrepreneur even if you still have a day job. Next, let’s talk about how to practically transition from one quadrant to another, because it’s common to start in one and move to others over the course of your life.

Transitioning Between Quadrants: How to Change Your Income Path

It’s important to realize that you are not stuck in one quadrant forever. Many people start as employees, then perhaps go solo, then maybe build a business, and eventually become full investors. Some juggle multiple quadrants at once (for example, an engineer with a 9–5 job (E) who also has rental properties (I)). In fact, you don’t need to jump all at once – you can maintain involvement in multiple quadrants simultaneously as you transition. For instance, you might remain employed while starting a side business, or keep running your business while funneling profits into investments. Combining roles can diversify your income and actually improve your security in the long run.

Every transition, however, requires a shift in mindset and strategy. Below are common moves between quadrants and tips on how to navigate them successfully:

From Employee (E) to Self-Employed (S) or Business Owner (B): Many people’s first move toward independence is either freelancing or launching a small business. To do this:

- Develop New Skills: Build skills relevant to the field you want to work in on your own. This could mean learning technical skills, marketing, sales, or whatever your prospective venture requires. Start developing expertise before you leave your job.

- Build a Network & Credibility: Establish relationships with potential clients, mentors, or business partners while you’re still employed. A network will help you get customers or guidance once you step out. Also consider doing small freelance projects in your spare time to build a portfolio and reputation.

- Start as a Side Hustle: You don’t necessarily have to quit your day job immediately. In fact, keeping your day job while growing a side business is a prudent approach. Thanks to technology, starting a small side business (a “side hustle” or even a micro-business) is easier than ever with minimal cost. You can create an online store, offer services on freelance platforms, or start a content business (blog, YouTube, etc.) during evenings and weekends. This reduces risk since you still have stable income while testing your business idea.

- Create a Business Plan: Treat your venture seriously by outlining how it will make money. Even if it’s small, clarify your target market, how you’ll deliver your product/service, and how you’ll manage financially during the transition. A simple plan acts as a roadmap and can highlight if you’re ready to go full-time or not.

- Financial Buffer: Save up an emergency fund or startup capital. Having a buffer of a few months’ expenses (or more) gives you confidence to leave the job and cushion if the new venture has slow periods early on.

From Self-Employed (S) to Business Owner (B): This transition is about scaling and systematizing what you already do. If you’re a successful freelancer or own a small practice, but you find yourself maxed out, it’s time to move to B by reducing your personal labor in the business:

- Systematize Your Operations: Document your processes and find ways to make your business run more systematically without your constant input. This could mean creating standard operating procedures, investing in software tools to automate tasks (like scheduling, billing, marketing), and streamlining how work is done. Essentially, turn your personal service into a replicable system.

- Hire and Delegate: Transitioning to B means you must start hiring people or partnering with others to share the workload. It could start with a virtual assistant for admin tasks, a junior colleague to take on more client work, or outsourcing certain tasks to contractors. Yes, it’s hard for a self-employed perfectionist to let go of control, but it’s necessary for growth. Focus on hiring people with skills that complement yours, and learn to trust and empower them.

- Shift from Worker to Leader: Your role should evolve from doing the core work to leading and growing the business. This means spending more time on strategy, business development, and mentoring your team, and less time on day-to-day client deliverables. Invest in developing leadership and management skills if they don’t come naturally. Remember, building a great team and culture will multiply your business far beyond what you can do alone.

From Business Owner (B) to Investor (I): Often a business owner will start generating more profits than they need to re-invest in the business or take as personal income. This is the prime time to become an investor and diversify your wealth beyond your own company:

- Educate Yourself on Investing: Learn about different investment vehicles (stocks, bonds, real estate, index funds, startups, etc.) and strategies. Even if you have financial advisors, as a business owner you’ll want to understand the basics of how to evaluate investments and manage risk. Many skills from business (like reading financial statements or assessing market opportunities) translate well to investing.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. As you free up profits, spread them across various assets – for example, some in the stock market, some in real estate, some in other businesses (perhaps you become an angel investor). Diversification helps protect you if any one investment performs poorly. It also exposes you to different growth opportunities, balancing risks and rewards.

- Leverage Expert Advice: Consider working with financial professionals for areas you’re less familiar with. For instance, hire a financial planner, tax advisor, or investment manager to optimize your strategy. As a business owner, you’re used to delegating to experts – do the same when managing substantial investment wealth. They can help with everything from asset allocation to tax-efficient investing.

From Employee (E) directly to Investor (I): It’s worth noting that some individuals go from Employee to Investor without ever owning a business or going solo. This typically involves diligently saving a portion of their salary and investing it over many years (in stocks, real estate, etc.) until their investment income can support them. If you choose this path, the key is consistent financial discipline: live below your means, invest regularly (e.g., in retirement accounts, index funds, rental properties), and let compound interest work its magic. Many people indeed achieve financial independence by their 40s or 50s by being smart, frugal employees who build a sizable investment portfolio on the side. In fact, starting as an “Employee + Investor” is a common strategy – you use the stable paycheck to invest for growth, gradually building passive income. This combination can later give you the freedom to transition to B or to retire early.

General Advice for Any Transition: No matter which move you’re making, here are universal tips:

- Mindset is Key: Embrace the mindset of the quadrant you want to move into before you get there. If you want to be a business owner, start thinking like a leader and looking for system improvements even if you’re currently self-employed. If you aim to be an investor, start educating yourself and thinking long-term even if you’re still working a job. A shift in mindset – from employee to entrepreneur or investor mentality – will guide your actions appropriately.

- Continuous Learning: All these changes require new knowledge. Invest in your financial education – read books, take courses, attend workshops, find mentors. The more you learn about entrepreneurship, management, and investing, the more confidence and competence you’ll have in the new quadrant. Also learn about taxes and laws affecting each quadrant; a little knowledge here can save or earn you thousands.

- Start Small, Then Scale: You don’t have to risk everything at once. It’s okay to start with a small side gig before quitting your job, or to invest a small amount before allocating huge capital. Prove the concept, gain experience, then scale up. Each small step will make the next one less risky and more informed.

- Financial Stability: Maintain some financial stability during transitions. This might mean keeping some income source as backup or having savings. Transitions often take longer and cost more than anticipated. A financial cushion keeps you from making desperate decisions or giving up too soon.

- Network with Like-Minded People: Surround yourself with others who have made or are making the transition you want. If you’re an employee wanting to start a business, connect with entrepreneurs. If you’re a business owner learning to invest, join investment clubs or groups. They will inspire you, share valuable insights, and maybe even become partners or mentors.

Transitioning quadrants is not always a linear, one-time event. Some people zigzag or straddle multiple categories. For example, you might move from E to S, realize it’s tough, go back to E for a while for steady income, then try again or move to B later. That’s okay – each attempt teaches you something. The goal is to keep moving toward the right side over time, because that’s generally where greater financial freedom lies. With today’s tools, an employee can start an online business with minimal money, or a small business owner can automate operations with technology, making these moves more accessible than ever.

The Cashflow Quadrant in Today’s Digital & Global Economy

Is the Cashflow Quadrant still relevant in the 2020s? Absolutely – in fact, the digital and global economy has in many ways made moving between quadrants easier and more common. Here’s how the modern landscape impacts each quadrant and the opportunities for transition:

- Rise of the Gig Economy (Empowering S quadrant): In recent years, there’s been an explosion of freelancers, contractors, and gig workers worldwide. As of 2023, nearly 48% of the global workforce is self-employed in some form. Platforms like Uber, Upwork, Fiverr, and Etsy have lowered the barrier to entry for people to earn income independently. This means many more individuals are exploring the S quadrant, even part-time, by monetizing skills or assets. It’s now normal for someone to have a side gig or freelance hustle alongside their job. This trend provides a stepping stone for moving out of traditional employment – you can test self-employment waters easily online. However, it also means the S quadrant is very crowded and competitive in certain fields (e.g., freelance design or writing). To stand out, one needs to continually upskill and find niche markets. The gig economy’s growth also highlights the importance of eventually moving to B or I for stability – as a solo freelancer, you’re one person in a large global pool, so building a unique brand or scaling into an agency (B quadrant) can set you apart.

- Online Business and Automation (Empowering B quadrant): The internet and technology have dramatically lowered costs and barriers to becoming a business owner. Today, you can start a global business from your laptop with minimal capital – whether it’s an e-commerce store, a software-as-a-service product, a content platform, or a YouTube channel. Digital tools and automation mean you don’t need a large staff to serve thousands or even millions of customers. For example, an online storefront can handle orders 24/7 automatically, digital products can be sold infinitely with near-zero marginal cost, and marketing can be done via social media at low cost. This enables even small entrepreneurs to achieve scalability (a key B characteristic) relatively quickly if they hit on a successful model. Additionally, remote work and freelancing platforms allow business owners to hire talent globally. You can outsource tasks to virtual assistants or developers or marketers around the world, often at affordable rates, to build your team. The world is your talent pool. In short, the digital economy has made the B quadrant more accessible; you don’t necessarily need a massive factory or storefront – you might run a whole enterprise from a home office. The challenge, however, is that everyone else can do it too – competition is global. Successful digital-age business owners focus on innovation, customer experience, and agile adaptation to stay ahead. Those who leverage analytics, automation, and online marketing effectively can turn a small startup into a big business quickly. We’ve seen many young entrepreneurs become very wealthy by leveraging internet platforms (think of app creators, influencers launching product lines, etc.). The lesson for someone aspiring to B quadrant today is: embrace technology and think globally. Even a traditional business (like selling crafts or teaching) can scale through online marketplaces or digital products.

- Access to Investing Tools (Empowering I quadrant): The investor quadrant is no longer exclusive to Wall Street elites or the very rich. Fintech innovations have opened up investing to the masses. There are micro-investing apps and platforms that let you start with just a few dollars, buying fractional shares of stocks or crowdfunding real estate deals. Robo-advisors can auto-invest your money based on algorithms, requiring little expertise. Commission-free trading apps have proliferated, meaning the costs to invest are minimal. All this means that even while you’re an employee or self-employed, you can begin accumulating investments earlier and more easily than previous generations. Moreover, informational resources are everywhere – countless blogs, YouTube channels, and online courses teach investing basics for free or low cost. However, with opportunity comes responsibility: the ease of entry means one must be cautious of impulsive or uninformed investing (as seen in the recent boom of meme stocks or crypto speculation). But overall, the global connectivity of finance (you can buy stocks in international markets, or invest in a startup halfway across the world via crowdfunding) provides diverse opportunities in the I quadrant. Additionally, interest rates in many places have been low, pushing people to invest in assets to outpace inflation – this social trend means even more average individuals are getting involved in investing for the future. If you’re building wealth today, taking advantage of these tools – in a prudent way – is almost essential to reach financial independence. You can start small (automatically invest a bit of each paycheck) and over time, harness market growth to potentially leave the rat race earlier.

- Remote Work and Hybrid Careers (Blurring E and S): The COVID-19 pandemic accelerated remote work, and now many employees work from home or have flexible arrangements. Some even work multiple remote jobs or a job plus side gig. This blurring of lines means someone can effectively be an employee while living like a self-employed (setting their own schedule at home) or can juggle multiple income sources more easily. Remote work also means companies are hiring globally, which might drive some to become contractors (S quadrant) instead of employees. In a broader sense, the definitions of these quadrants are evolving. For example, we see the rise of the “solopreneur” – one person businesses that utilize outsourcing and digital reach to function like a small company (is that S or B? It might start as S, but with enough outsourcing and systems, it could qualify as B-lite). The key takeaway is that the digital, global economy provides flexibility: you can design a work-life that suits you and transition gradually. You might negotiate a part-time remote arrangement at your job to free up time to build your business. Or you might remain an employee but build a substantial investment portfolio on the side with the higher salary you earn in a global tech job. In effect, the quadrants can be mixed and sequenced in creative ways now.

- Global Markets and Multiple Streams of Income: In the modern economy, diversification isn’t just an investor concept; it’s a career concept. Many individuals aim to have multiple streams of income – a bit from a job, a bit from a side business, some from investments. This approach aligns perfectly with the quadrant model: it’s not either/or, it’s how many quadrants can you tap into? The more you do, the more secure and empowered you might feel. For example, someone could be an Employee + Investor for stability, or Self-Employed + Investor, or even all three (while building a Business). The global marketplace allows even small players to reach customers or opportunities that were once out of reach. You can publish an e-book (small B quadrant move) and earn royalties (a bit of I quadrant flavor) while still working a job (E quadrant) – all thanks to digital distribution worldwide. Similarly, you can live in a country with limited local investment options but use online brokerages to invest in international stocks or buy cryptocurrencies. In essence, geography is less of a barrier now; the playing field is more level for those who seek to improve their financial position.

In conclusion, today’s economy doesn’t change the Cashflow Quadrant model – it amplifies it. The principles of how money is earned remain, but the means to achieve them are more accessible. The digital age rewards those who can adapt: learning new skills quickly, leveraging online platforms, and thinking beyond traditional job boundaries. It’s also a fast-changing environment – industries rise and fall quickly (who heard of social media influencers as a business 15 years ago?), so being financially independent via multiple quadrants provides resilience. Apply the quadrant model to identify where you are and what opportunities new technology might give you to move toward the right side. For instance, if you’re an expert in something, you could create an online course (turn your expertise into a product – moving from S to B). If you have savings, you could participate in peer-to-peer lending or equity crowdfunding (new I opportunities). The global and digital economy is an enabler – it’s up to you to take initiative and harness it on your journey to financial freedom.

Strategies for Building Financial Independence

“Financial independence” means you have enough income from your investments or business ventures to cover your living expenses without relying on a paycheck. Mastering the Cashflow Quadrant is essentially a road map to get there. To wrap up this guide, let’s summarize some key strategies, pulling together lessons from each section:

- Cultivate a Financial Freedom Mindset: Everything starts with mindset. Embrace the idea that you can improve your financial situation and eventually achieve independence. This means shifting from thinking like a worker to thinking like an owner or investor. Challenge assumptions like “I’ll always have to work till 65” – instead, ask “How can I make money work for me?” Adopting an abundance mindset (looking for opportunities rather than focusing on scarcity) will keep you motivated and creative. Also, be willing to step outside of comfort zones – every quadrant shift involves learning and risk, but also reward.

- Live Below Your Means and Save to Invest: Whether you’re an employee or already a business owner, consistently spending less than you earn is crucial. The surplus is what fuels your moves to the next quadrant. As an employee, treat savings as the capital for your future business or investments. As a business owner, don’t just inflate your lifestyle with your profits – allocate a portion to investments. This disciplined approach creates a bridge to the Investor quadrant. Automate your savings and investments if possible (for example, automatic 401(k) contributions or monthly transfers to a brokerage account) to make wealth-building a habit.

- Focus on Increasing Your Income (Active then Passive): In the early stages, it helps to boost your active income – that might mean improving your career skills to get a raise, or expanding your freelance services to earn more. The extra income can accelerate your goals (like paying off debt, saving seed money for a business, or investing more aggressively). But as you earn more, direct those gains into passive income vehicles. For instance, if you get a raise or a higher paying job, resist lifestyle inflation – invest the difference. If your side hustle starts earning nicely, reinvest profits into scaling it or into other assets. Remember, the end goal is to create income sources that do not require your constant effort.

- Develop Marketable Skills and Financial Literacy: Education is your ally. Marketable skills (technical, managerial, sales, etc.) will open opportunities in E and S quadrants and make you more effective in B. Equally important is financial literacy – understanding how money, investing, and business work. Read books, follow financial news, take courses on entrepreneurship or investing. The more you know, the more confidently you can move in the right-side quadrants. For example, learning about marketing can help a self-employed person attract more clients (higher income), and learning about stock analysis can help you grow as an investor. Many people achieve breakthroughs after educating themselves – it clicks how to launch that business or what investment strategy suits them. Never stop learning; even after you’re financially free, continuous learning will help you adapt and preserve your wealth.

- Build a Side Hustle or Business with Scalability in Mind: If you’re an employee today, strongly consider creating a side income project. It can be modest – a small e-commerce store, freelancing on the side, a YouTube channel, anything. The experience is invaluable. Aim to choose something that has the potential (even if not initially realized) to scale beyond just you. For example, freelancing can later turn into an agency, or an online blog can turn into a digital product business. By planting seeds in the B quadrant early (even if they’re tiny), you prepare for a future where that could become your main income. Plus, the extra income from a side hustle can be invested, speeding up your I quadrant growth. Many have used side hustles as the launching pad to quit their jobs and become full entrepreneurs once the income was sufficient.

- Network and Find Mentors: Surround yourself with people who are where you want to be. If you want to start a business, join entrepreneur meetups or online communities; if you want to invest, consider an investment club or find a seasoned investor willing to share insights. Mentors can fast-track your learning by sharing mistakes to avoid and best practices. Networking can also lead to partnerships – maybe you meet a co-founder for a business, or an investor who funds your idea. These relationships can open doors that solo effort might not. And even within your peer group, having like-minded friends keeps you accountable and inspired – they’ll cheer you on when you make progress and motivate you when times get tough.

- Embrace Failure as Feedback: On the journey through different quadrants, setbacks are inevitable. Not every business idea will succeed; not every investment will yield gains. Treat these experiences as feedback, not fatal. Learn the lessons, adjust your strategy, and continue forward. Many successful business owners failed multiple times before finding the right venture. Many investors made mistakes early on before refining their approach. If you stay persistent and keep learning, failures can become stepping stones to success rather than roadblocks. The only true failure is giving up entirely on your goals.

- Multiple Streams of Income: As you progress, aim to establish multiple income streams, ideally spanning different quadrants. This not only accelerates reaching financial freedom but also makes it more resilient. For example, you might have rental income (I quadrant) alongside your business income (B quadrant), and perhaps some royalty income from a book you wrote (could be I quadrant too, or B if treated as a business). Diversifying income streams is like diversifying investments – it protects you. If one source falters, others can support you. Many financially independent people have 5, 6, or more income streams. You don’t need that many to start, but over time keep adding and diversifying how money flows into your life.

- Stay the Course (Long-Term Thinking): Building financial independence is a marathon, not a sprint. Even though some people strike it rich quickly, that’s the exception, not the rule. The quadrant model reminds us there is a progression: it might take years to move fully from Employee to Business Owner, or to build enough investments to live on. Don’t be discouraged by early modest results. Small steps, consistently taken, compound into huge results – just like money compounds with interest. Keep your vision of freedom in mind and celebrate milestones along the way (like when you pay off a debt, or your side hustle covers a bill, or your investments hit a new high). If you remain persistent and adaptable, the cumulative effect of your efforts will lead to financial independence in due time.

- Retain Balance and Purpose: Finally, remember that financial independence is not just about money; it’s about what money enables – time with loved ones, pursuing passions, contributing to community, etc. As you work through the quadrants, try not to sacrifice health, relationships, or happiness in blind pursuit of wealth. Ideally, find purpose in the process: maybe you love the creativity of building a business, or the intellectual challenge of investing, or the service you provide as a professional. That will keep you motivated beyond just the dollars. And once you do achieve income freedom, have a plan for how you’ll use that freedom meaningfully. Many financially independent individuals continue to work or create, but on their own terms and often on things they’re passionate about. Money is a means to an end – the end is a fulfilling life. As you apply these strategies, keep your life goals front and center.

The journey to mastering the Cashflow Quadrant is both a financial and personal growth adventure. We’ve explored how each quadrant – Employee, Self-Employed, Business Owner, Investor – has its unique mindset, advantages, and challenges. There is no single “right” quadrant; each can play a role at different stages of your life. The key is to be intentional about where you are and where you’re headed. If your aim is true income freedom, the roadmap is clear: gradually transition from the left side (working for money) to the right side (money working for you). Millions of people have done it, and you can too.

Remember, it’s not about rushing and despising any quadrant – there’s dignity and learning in each. It’s about knowing where you want to go. Perhaps you love your job (E) but also build investments (I) to retire early. Or you turn a freelance gig (S) into a company (B) that one day runs without you. Your path will be unique, but the principles remain: build assets, not just income; seek freedom, not just security; and think like an owner, not just a consumer. Keep learning, stay proactive, and maintain a positive, resilient mindset.

Ultimately, mastering the Cashflow Quadrant means mastering your financial destiny. It’s about gaining the freedom to choose how you spend your time and what you work on, without being chained by money worries. Every small step you take – saving a dollar, starting a side project, investing in a stock, delegating a task – is moving you along that quadrant spectrum. So ask yourself today: Which quadrant am I in, and which quadrant do I want to move toward? And then, with the insights from this guide in mind, make your move. Your journey to income freedom has already begun. Good luck, and enjoy the climb towards a life where you control your financial future!